Your Ultimate Guide to CTOS Reports & Loan Rejection in Malaysia (2024).

First, let's understand what's a CTOS Report.

- CTOS and CCRIS are two credit reporting agencies in Malaysia that provide credit information about individuals and businesses to lenders and financial institutions

- Understanding your CTOS report is crucial, as it can influence the approval or rejection of credit applications.

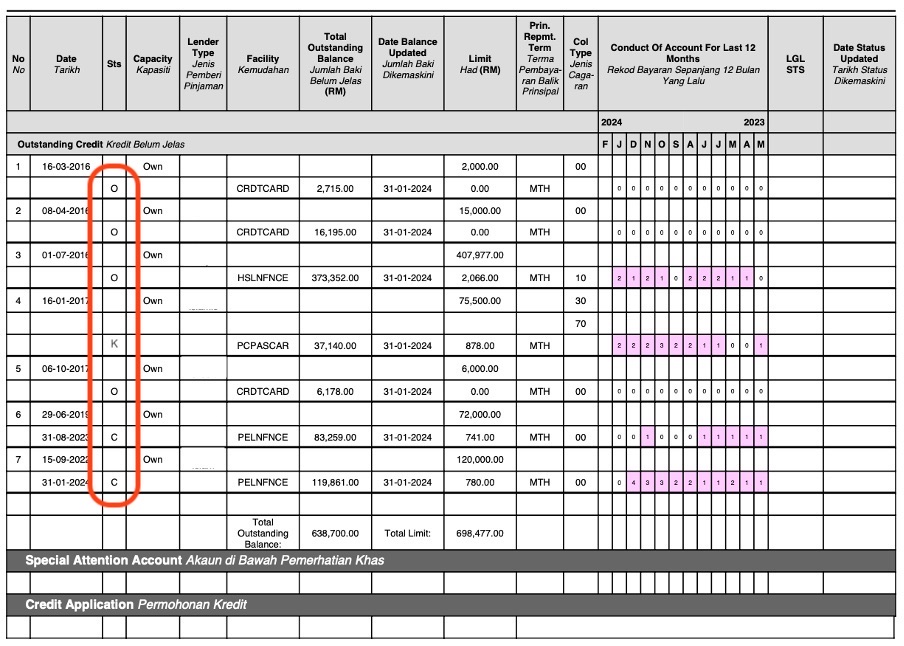

STEP 1: The banks will first review your loan status

The loan status shows your loan payment records

O: Outstanding;

K:AKPK

C/T: Restructure or Reschedule

Having an AKPK or restructured/rescheduled loan makes it challenging to get a new loan because it indicates that you are facing serious financial difficulties and are unable to manage your debts on your own.

Which will cause rejection to your application.

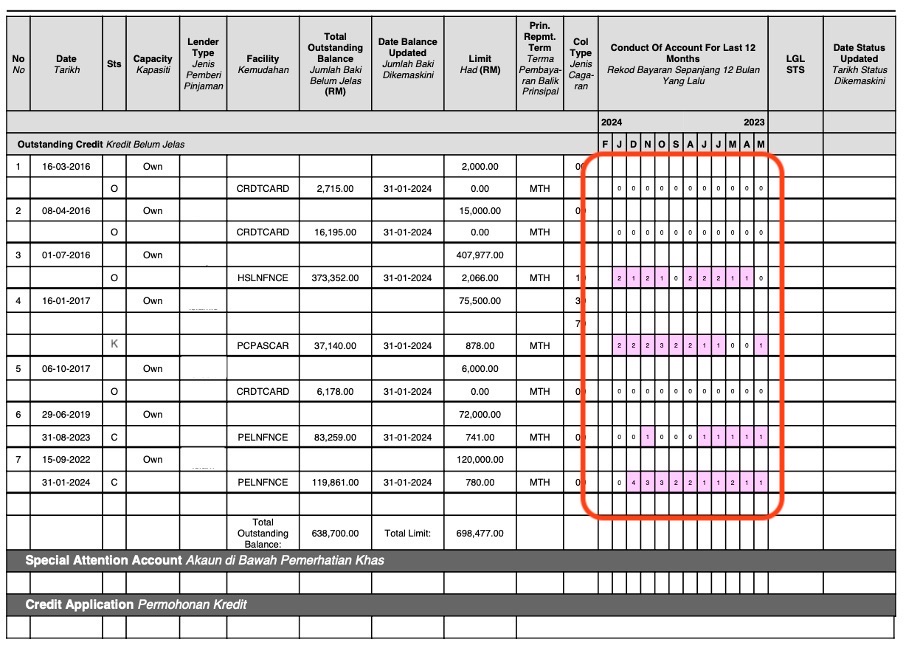

STEP 2: The banks will then look at your payment record (Payment History of any Loans, Credit Card & Personal Debts)

Loan payments for the past 12 months:

0 means payment was made on time.

1 means payment is delayed by 1 month.

2 means payment is delayed by 2 months.

Please note: A payment delayed by 1 day is also considered as a delay of 1 month.

Your payment record can impact your application as banks may observe a negative payment history, reflecting poor payment behaviour.

Profile having 2 months late payment will have a high potential to be rejected by the banks.

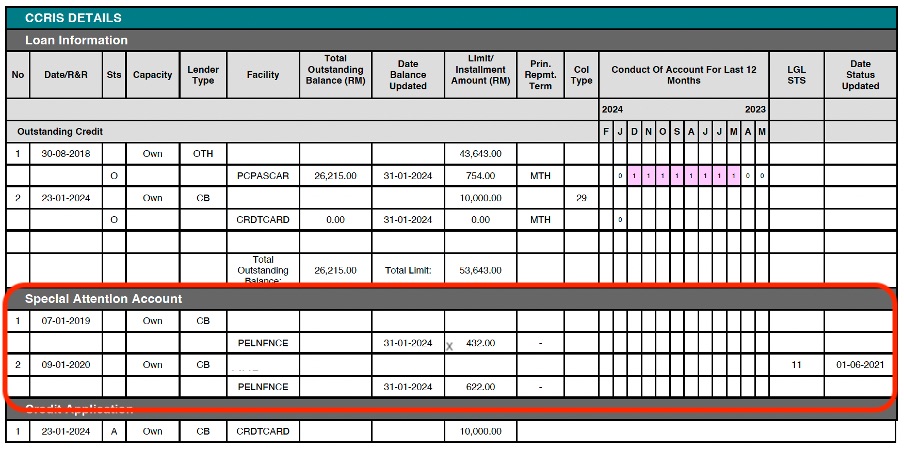

STEP 3: Checking for SAA (Special Attention Account):

If your account has payments overdue for more than 3 months, it will be classified under this Special Attention Account or SAA for short.

SAA refers to outstanding debts that remain unresolved and are still under the bank’s observation. If you have records in this category, approval for any new loans will not be granted unless the outstanding loans are settled or paid off.

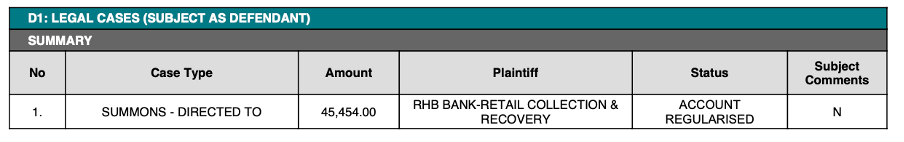

STEP 4: Checking for Legal Statuses

This indicates your legal status. If this status is not resolved, it can lead to a bankruptcy profile, making you ineligible to apply for any loans unless you make a full settlement.

Take note: legal status might bring you to bankruptcy.

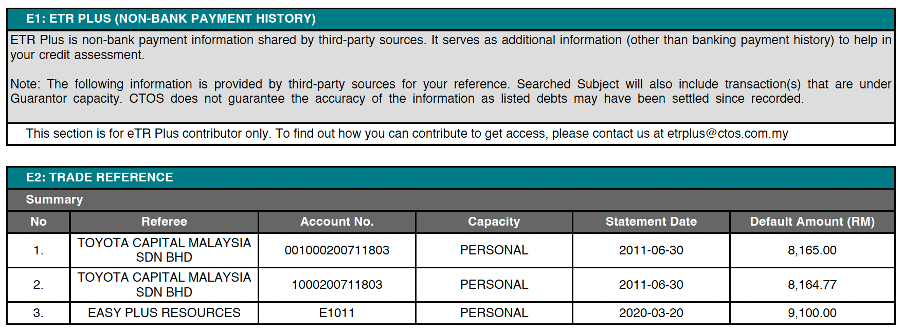

STEP 5: Checking for CTOS BLACKLIST

CTOS Blacklisted:

Any borrowings from non-financial institutions or any outstanding debts, including mobile bills, TNB, money lenders, or unsettled dues with shops, will be reflected in your CTOS report. This status can affect your ability to obtain a loan unless you either make a full settlement or have this status removed.

Take note: Certain banks may accept CTOS blacklist profiles for loans. To learn more feel free to contact our advisors.

That sums up the loan application process and what banks check for on your CTOS reports before granting you a loan.

If you’re in this situation or face any issues getting a loan due to financial issues, let us help you. Fill in the form below to connect with our advisors today to see how we can help you overcome your financial difficulties.

Let Us Help You With Your Financial Issues Today

Connect with a MTI Golden representative today. Talk to our consultant to see how we can help you overcome your financial problems.