Refinancing & Mortgage Advisory

Facilitating home loan approvals and refinancing options to assist clients in cashing out or consolidating their debts.

Client's Challanges

Credit Card Burst

This pertains to exceeding the credit card limit or maxing it out without the intention of settling the resulting bill.

Low CTOS Score

A low CTOS score may result from unfavorable payment habits.

Commitment / DSR Burst

This occurs when current financial commitments surpass the monthly income spending limit.

SAA (Special Attention Account)

SAA refers to a Special Attention Account, indicating blacklisting by specific banks. Obtaining a loan is impossible unless a full settlement is made.

AKPK (Credit Counselling and Debt Management Agency)

AKPK assists individuals in gaining control over their financial situations. However, individuals enrolled in this program are less likely to receive loan offers from banks.

CTOS Blacklisted

Any borrowings from non-financial institutions or any outstanding debts, including mobile bills, TNB, money lenders, or unsettled dues with shops, will be reflected in your CTOS report.

Refinance Mortgage

Mortgage Loan

Secure your dream home with our Mortgage Loan services. We assist you in obtaining the financing you need to make homeownership a reality.

Refinance

Optimize your finances with our Refinance services. Not only can you potentially lower interest rates or adjust the loan duration, but you can also get cash out, providing you with additional financial flexibility.

Debt-to-Property

With our Debt-to-Property Conversion Service, we assist customers in transforming all their debts into a housing loan, enabling them to acquire a property for investment purposes.

Why Choose Us ?

At MTI Golden, we specialize in providing credit score and financial services that are tailored to solve your financial needs.

Years of

Extensive banking, personal finance & debt consolidation experience.

Established Connections

With 18 banks in Malaysia, including Islamic Banks.

Clients Assisted in

Resolving their financial burden & debt issues with the banks.

Approval Rate in

Helping clients to get their personal / business loan approved.

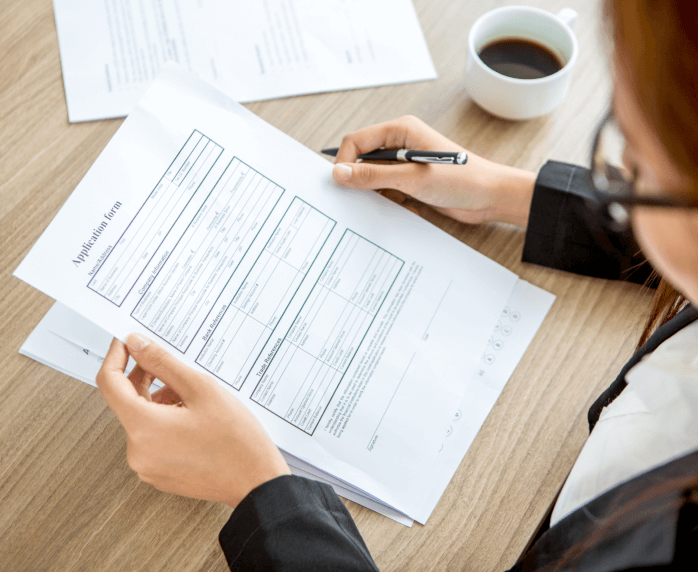

Application Process

01

Consultation Process

Schedule a consultation with our financial experts to discuss your goals and challenges.

Documents needed:

Employee/ personal profile

1 ) 3months payslip

2 ) EPF 2 years

3 ) CTOS Report

Employer/Business profile

1 ) 6 month bank statement

2 ) SSM and SSM info

3 ) CTOS report

4 ) income taxes claimed

02

Customize plan

1 ) received a personalized financial recovery plan tailored to your specific needs

2 ) signing for AGREEMENT and PROPOSAL before proceed

03

Implementation Process

1 ) Work with our team to implement the strategies outlined in your recovery plan.

2 ) Track your progress and make adjustments as necessary to achieve your financial goals.

04

Approval

1 ) Get the approval from bank

Client's Testimonials

See what our satisfied clients have to say

Nurul Afiqah Binti Yusof

AKPK+SAA

Thanks for helping get loan approval for my weddings 😊

Handled by:

Allen Gan

Financial Consultant

Siti Aishah Binti Jamal

SAA + High Commitment

tq so much MTI... finally no blacklist in my profile

Handled by:

Allen Gan

Financial Consultant

Shalini A/P Subramaniam

High Commitment + Credit Card Burst

i was almost bankrupt because of MCO.. MTI save my business and my personal profile

Handled by:

Allen Gan

Financial Consultant

Let Us Help You With Your Financial Issues Today

Connect with a MTI Golden representative today. Talk to our consultant to see how we can help you overcome your financial problems.

FAQS

Explore our FAQ section for quick answers to common queries, providing you with instant clarity and assistance.

Yes. We can assist in resolving your AKPK status and present you with a tailored offer. Please consult with our financial advisor for a thorough profile assessment.

Yes. We assess eligibility for clearing SAA and Internal blacklist on a case-by-case basis. Before any decision, we need to check your profile thoroughly. Please consult with our financial advisor for a thorough profile assessment.

Only employees working in specific companies such as MNCs, GLCs, or government-linked companies are eligible if there is a legal case in their profile. To proceed, please provide your CTOS report and payslip for consultation with our consultant. This will be used to verify eligibility against the bank panel list. Please consult with our financial advisor for a thorough profile assessment.

Yes. We offer assistance for individuals with low CTOS scores through our MTI Financial Hospital Program. This program is designed to support customers facing financial challenges. After undergoing the prescribed “treatment,” we aim to restore your credit scoring to normal levels. Please consult with our financial advisor for a thorough profile assessment.

No. We do not accept foreign workers.

We do not accept Malaysians working in other countries However, if you are employed in Singapore with a monthly salary exceeding 3,000 SGD, you may be eligible for our services.

It’s possible that your low CTOS score is a result of joining AKPK, being blacklisted, or having a history of late payments. Our Financial Hospital Program is designed to assist individuals facing such challenges, aiming to improve your financial situation and, subsequently, your credit score. Please consult with our financial advisor for a thorough profile assessment.

A bank rejection can occur for various reasons, such as a low CTOS score, AKPK membership, SAA status, blacklisting, or a history of late payments. To understand the specific reasons for your rejection and receive tailored advice, I recommend consulting with our professional consultants. They can provide guidance based on your individual financial situation.

The processing time for your case will be determined on an individual basis. Please consult with our financial advisor for a thorough profile assessment.

We do not require any upfront payment or deposit. The charges for proceeding will vary on a case-by-case basis. It is advisable to seek professional advice from our consultants to understand the specific costs associated with your situation.

As of now, we operate three branches in Malaysia located in Kuala Lumpur (KL), Penang (PG), and Kedah. We will soon be opening a new branch in Johor Bahru (JB)

Check out the branch address:

MTI GOLDEN (SUNGAI PETANI) ADDRESS:No 207, 1st Floor, Jalan Mawar 3/2 Taman Pekan Baru, 08000 Sungai Petani Kedah.

MTI GOLDEN(PENANG) ADDRESS:NO. 81-1, (First Floor), Jalan Todak 6, Pusat Komersial Sunway Perdana, 13700 Perai, Penang.

MTI GOLDEN(KUALA LUMPUR) ADDRESS:MTI Golden Sdn Bhd, Block A-10-4 Northpoint Mid Valley City, Lingkaran Syed Putra, Kuala Lumpur

Walk-ins are allowed, we don’t recommend it. We need time to find solutions and check your profile. It’s best to make an appointment and gather your documents before coming in for a more helpful response.